A summary of the latest Finextra report on payments and innovation

Payments transformation is becoming a cliche and asking banks whether they have a payments transformation strategy is almost pointless as the answer is always ‘yes’. Transformation of payments is a major and necessary focus for banks and as it is pointed out: “if you take your eyes off disruption for a moment, it can happen overnight – and this is what keeps me awake.”

The main key drivers for transformation are: regulation, changing customer expectations and technology, but one should also consider other factors like the trend of globalisation or simple economic reality and economic growth. PSD2 is a critical change factor as well because it is opening up the landscape to new competition, as well as requiring banks to make a whole host of other changes in order to comply.

As George Doolittle, Head of Global Financial Institutions Payment Services, Wells Fargo, points out: “We start with the customer first,” he says. “We have an enormous customer base and from a demographic perspective we have millennials who want the latest in technology, and we have a massive baby boomer population looking for safety and security. It’s a continual balancing act.”

While easy to use but incredibly powerful technology is clearly influencing the way consumers approach banking, the lure of high-tech is not always so strong for corporates as investment in a new technology takes time to get the funding and support.

Transformation activity is being driven by a trend related to real-time – the wider adoption of ISO 20022 formatted messages in the payments industry. “Various countries are looking to accelerate and implement real-time payments solutions, and this is not just about providing payments faster, it’s also about providing more data and consistency and conforming to the global ISO 20022 standard. In this context, real-time reconciliation becomes

possible: I get the payment, I know specifically what I am being paid for, and

I can immediately apply that cash and make a decision about subsequent credit.”- says Cindy Murray, Head of Credit Ful llment, Service & Operations in Global Banking Operations at Bank of America Merrill Lynch.

Security and legacy: If banks were free to make whatever use they liked of every available technology there is probably no limit to the innovation they could introduce into their payments businesses. but in reality of course they are not free. They need to be careful- “transformation is good – but payment systems need to be robust and resilient, because they are core to the economy of any country” points out Alistair Brown, Global Head of Payments EPAM. In addition to regulation, customer needs and technology change, banks’ thinking about payments transformation is then inevitably also shaped by considerations of fraud and cyber security – and this colours their approach to any innovation.

Can banks really win the payments business of the future? Though banks should not ignore new sources of competition, they should be confident in their ability to respond. “The challenge for banks is to get their heads around the risk and their own risk appetites for partnering and trialling new technology and new emerging services. <…> We are already seeing and will continue to see fintechs pairing up with banks, with the banks providing the settlement services behind the services the fintechs are creating.” says Brown.

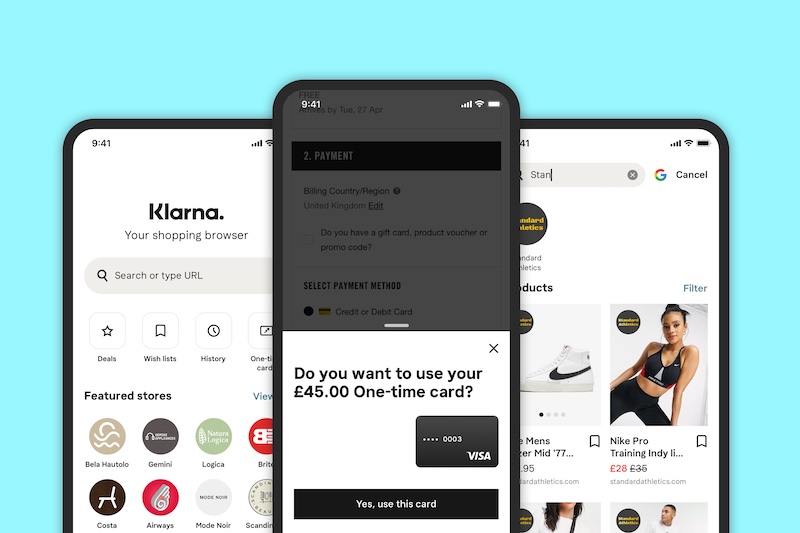

A. Brown adds that “as the data around payments becomes more important, the banks need to be able to learn in particular from large retail organisations and other businesses that have got very smart at using customer data. They’ve got to be able to bring in new skills and learn from other industries about how to create the frictionless, straight-through service customers are looking for. We all want things to happen with one click: and that one click has got to be absolutely secure.”

In conclusion, payments transformations is a given, and the drivers for change are well recognised. The question the banks have to answer is how they will respond, as the inexorable rise of real-time payments and unstoppable force of open banking continue to further reshape the landscape in which they operate. Most banks still have to do something to tackle their legacy system challenges – without playing fast and loose with either security or customer protection, a significant responsibility which they factor in to all their innovation thinking.

There are number of options for banks looking to reinvent their business models and their technology infrastructures to face the brave new world of payments. Critical for success will be acknowledging how thorough that reinvention will need to be if the banks are to fend off new sources of competition and continue to dominate in the lucrative payments industry of the future.

“If the banks fail to respond strategically to the fundamental changes enabled by these changes in payments, they run a real risk of losing their natural advantages and sleep-walking into irrelevance.” – A. Brown.

Download the report here